Pony AI Expands Globally Post-Nasdaq Debut Amid Rising Competition

Pony AI's Strategic Focus on Supply Chain Diversification

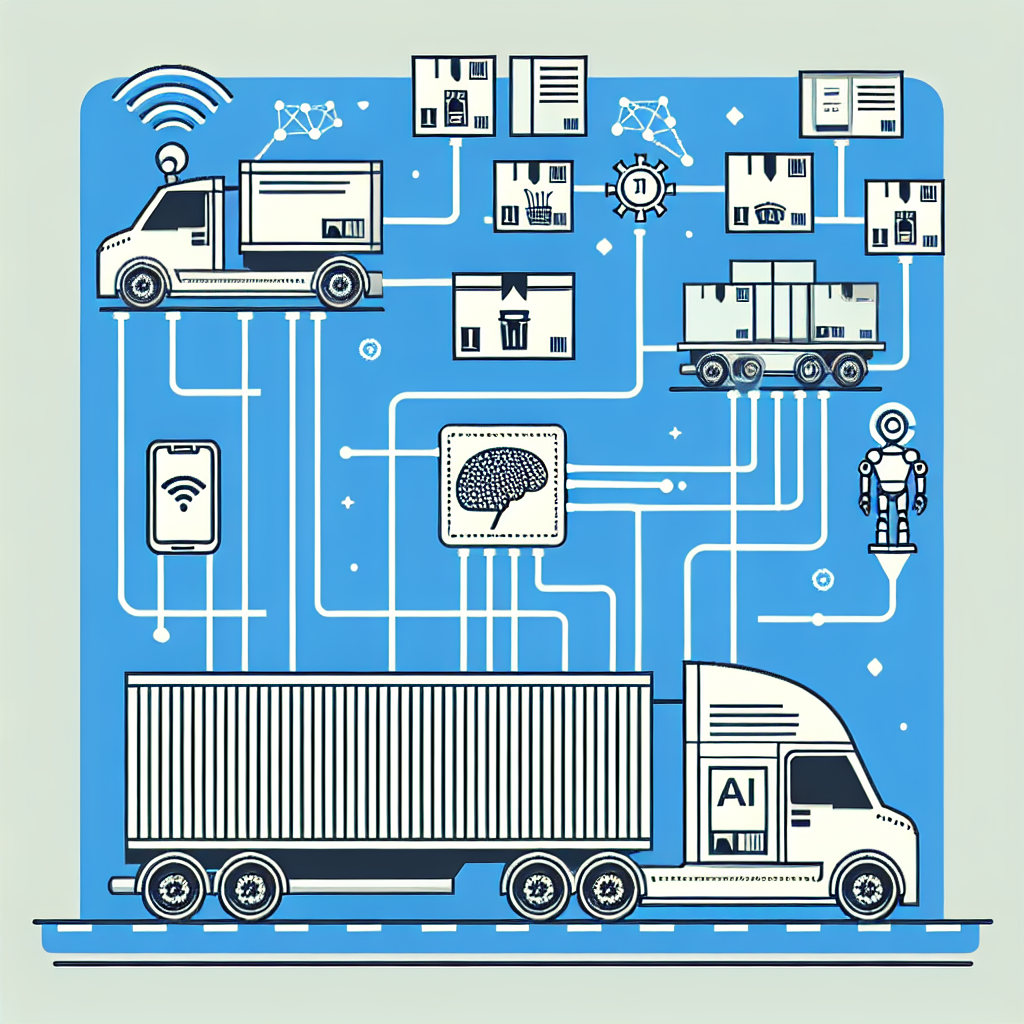

Pony AI, a leading player in autonomous driving technology, is making strategic moves following its recent Nasdaq debut. The company is actively working on diversifying its supply chain as a response to the geopolitical tensions between the U.S. and China. According to James Peng, CEO of Pony AI, such strategies are not new to the company as they have been long prepared for potential chip export restrictions that could arise due to international political issues.

As a part of its action plan, Pony AI aims to source chips and other essential components from a broader array of suppliers, both within China and globally. This is an effort to mitigate risks associated with dependency on a single region, thereby strengthening its business resilience. The company believes that as more manufacturing capabilities emerge worldwide, diversifying the supply chain will be crucial to maintaining steady growth and operation.

Global Market Expansion Plans

Moreover, Pony AI plans to enhance its market presence internationally. The company's expansion strategy includes aggressive growth in markets such as South Korea, Singapore, and the Middle East. This move not only helps in mitigating risks related to geopolitical tensions but also positions Pony AI to tap into emerging markets where the demand for autonomous driving technologies is anticipated to soar.

In parallel, Pony AI continues to invest in enhancing its fleet capabilities. It already operates a substantial number of robotaxis and robotrucks in China and is poised to expand these operations globally. The company's competitive spirit is evident as it challenges major contenders such as Tesla, Waymo, and Amazon's Zoox, each of which has substantial investments and active projects in the autonomous vehicle market.

Competitive Landscape of Autonomous Driving

The landscape of autonomous driving is fiercely competitive, with heavyweights like Tesla pushing forward with their Full Self-Driving (FSD) fleets, and Waymo delivering commercial services across U.S. cities like Phoenix and San Francisco. Other players, such as GM-backed Cruise and Amazon's Zoox, are also making significant strides in developing niche solutions to capture different segments of the market.

Pony AI's efforts to establish a stronghold globally will test its technological prowess and market adaptability. Innovation in AI, integration with existing transportation networks, and regulatory compliance will be crucial for success in these ambitious expansion plans.

Financial Performance and Market Reaction

Following its IPO, Pony AI's stock experienced a rocky start, closing the first day of trading at $12.00, a decrease from its IPO price of $13, reflecting a cautious investor outlook amidst broader market uncertainties. Nevertheless, initial after-hours trading showed a slight recovery, signaling potential investor confidence in Pony AI's long-term strategy.

As Pony AI continues to navigate through its early post-IPO phase, its focus on building resilient supply chains and expanding its market reach are critical steps towards establishing a dominant presence in the future of autonomous transportation. These strategic moves position Pony AI to potentially emerge as a global leader in the autonomous driving and AI technology sectors.